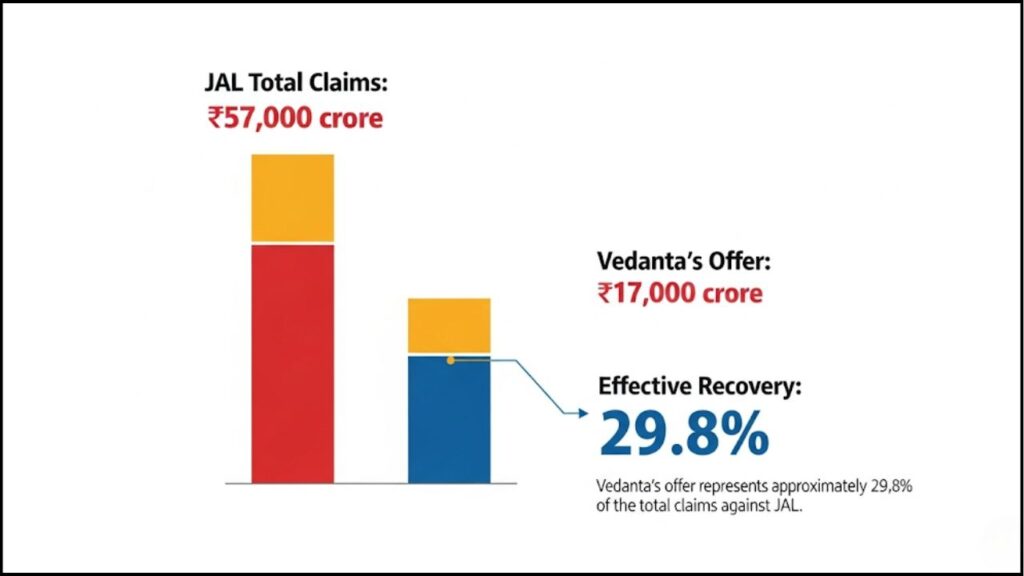

Vedanta Group has secured the acquisition of Jaiprakash Associates Limited (JAL) with a ₹17000 crore bid, surpassing rival Adani Group during a creditors’ auction held on 5 September 2025. The deal provides partial relief to JAL’s lenders but signals a steep loss on outstanding claims exceeding ₹57,000 crore.

How Vedanta Outbid Adani

Vedanta emerged victorious in the final round of bidding, which began at a floor price of ₹12,000 crore. Only Vedanta and Adani submitted firm proposals in the conclusive stage, according to coverage in Business Standard and Economic Times.

The winning offer translates into a net present value (NPV) of approximately ₹12,505 crore, which creditors considered superior to Adani’s bid. Although the recovery plan represents just 29 percent of the verified claims, it is the most competitive proposal presented in JAL’s insolvency proceedings so far.

Context of the Insolvency

Jaiprakash Associates, once a diversified conglomerate spanning cement, real estate, and infrastructure, entered insolvency after years of mounting debt and stalled projects. Creditors have pursued multiple restructuring attempts since 2017 under India’s Insolvency and Bankruptcy Code (IBC).

According to Moneycontrol, the Committee of Creditors (CoC) finalized Vedanta’s proposal following a marathon auction. The outcome reflects broader efforts by Indian banks to resolve large non-performing assets through competitive bidding.

Strategic Implications for Vedanta

The acquisition broadens Vedanta’s portfolio beyond its traditional focus on mining and natural resources. JAL’s assets include cement production, power generation, and real estate ventures. Analysts suggest the move signals Vedanta’s intention to diversify revenue streams amid volatile commodity markets.

“This deal provides Vedanta access to established cement plants and infrastructure projects, which could generate stable cash flows,” said an industry analyst quoted by Livemint. However, others caution that integrating JAL’s distressed assets may pose operational and regulatory challenges.

Impact on Creditors and Market

For JAL’s lenders, including major Indian banks, the deal ensures some degree of recovery though it involves a significant haircut of more than 70 percent. According to reports in The Economic Times, creditors had little choice given the prolonged insolvency and dwindling asset valuations.

Market observers note that the outcome underscores the fierce competition among India’s largest conglomerates for distressed infrastructure assets. It also reflects the continuing pressure on banks to expedite resolution of legacy bad loans.

Looking Ahead

The acquisition must now secure approvals from India’s National Company Law Tribunal (NCLT). If cleared, Vedanta will assume control of JAL’s businesses in cement, power, and real estate. Analysts expect a gradual restructuring of operations to align with Vedanta’s long-term strategy.

For Adani, the loss highlights intensifying competition in India’s corporate restructuring market. For Vedanta, the outcome marks a bold expansion into sectors beyond metals and mining.

GST Refunds in 7 Days and Business Registration in 3—Big Reform Announced

Conclusion

Vedanta’s ₹17000 crore takeover of Jaiprakash Associates represents one of India’s largest insolvency resolutions in recent years. While it delivers limited relief to lenders, the move reshapes Vedanta’s corporate trajectory and reflects the growing rivalry between India’s leading conglomerates.